Upcoming Events

Upcoming Webinars

23 Apr 2024 (Tue) 12:00p.m – 2:00p.m

Many people believe that once they retire, they need to focus on attaining “dividends” — which results in them putting most or even all of their savings into investments that generate regular payouts such as bonds, REITs, dividend stocks, unit trusts, or a combination of these.

Does this approach have any shortcomings and what are the optimal steps you can take when choosing to go with this investment strategy?

In this webinar, Darren will share with you:

- What is Dividend Investing

- The dos and don’ts of Dividend Investing

- How much will you actually need in retirement

- How to outlive your nest egg and get stable dividend income for life

- How to create a multi-asset retirement dividend portfolio

The webinar serves as a preview for the Lifetime Income Mastery & REITs Analysis course

23 Apr 2024 (Tue) 7:00p.m – 9:00p.m

As the uncertainty around Fed rate cuts mounts, markets are shifting their attention to more concrete “big” happenings, namely stubborn inflation rates in the US and the climbing 10-year treasury yield, oil prices hitting new highs, and the Bank of Japan’s first departure from negative rates in 17 years.

Now the burden lays on the Fed’s shoulders, their decisions on when and how much of a cut likely determines how the markets will fare for the coming months. Not forgetting November’s US presidential elections, which might pit Biden against Trump once again, and most likely further shaking the markets.

Tech stocks are persistently high on the back of unwavering hype of AI-backed ideas, albeit pace in gains is beginning to slow down. The Chinese economy and property market are starting to show signs of life, which is a comforting note.

What if I told you our trading system can help you identify the soaring dragons and avoid the sleeping dragons. And the dragons that do soar are usually resilient enough to even excel in tough conditions and outperform the rest of the market.

That’s not all – we even knew EXACTLY when – specific price points, down to the CENTS – to get in, days or sometimes even WEEKS ahead. Best of all, it works for BOTH upward and downward trends – we can make gains from shorting the stocks that don’t manage to soar amidst market pressures.

The Managing Explosive Swings (MES) proven trading system picks out the STRONGEST price signals, which tell us the stocks that are most likely to not just survive in tough conditions, but excel and outperform.

Learn more about this proven trading system with concrete examples and how to SENSE the correct SIGNALS of the market’s soaring dragons (market leaders) in CK Ee’s FREE 2-hour live webinar

All of our Zoom Webinars are password protected, which will only be provided upon registration on Zoom.

- H1. How to set up and catch the strongest signals of potential market leaders poised for EXPLOSIVE gains beforehand (likewise for stocks about to plunge)

- How to get PRECISE entry and exit points to maximise profits and minimise losses (regardless whether it’s a bear or bull market)

- How to EXPLOIT strong market sentiments created by positive news and the “Big Fishes” A.K.A. fund managers and institutional investors

- How to REPEAT this process to make CONSISTENT profits regardless of market conditions and risks

5. BONUS: Short selling opportunities when market leaders face severe correction because of the “Big Boys” collecting profits

The webinar serves as a preview for Mastering Explosive Swings course

24 Apr 2024 (Wed) 7:00p.m – 9:00p.m

Recently, DBS announced a bonus payout of 1 bonus share for every 10 DBS shares owned.

This sparked increased interest in DBS shares among investors. Many have inquired about the potential of this bonus share offer as a favorable investment opportunity. Being able to understand the nature of corporate actions and the rationale behind companies’ choices in implementing them is crucial. Equally important is discerning how to capitalise on such corporate actions for financial gain.

In this webinar, Jay will impart insights on managing corporate actions such as dividends, bonus shares, and rights issues, while also show you how to avoid associated pitfalls.

In this complimentary live webinar, Jay will share with you:

- What are corporate actions like dividends, bonus & rights?

- Why does companies issue corporate actions?

- How to handle dividends, bonus & rights issues.

- Building a successful investment strategy using corporate actions.

CMT Level 2 Exam requires the candidate to demonstrate a greater depth of competency and proficiency by applying more advaced analytical techniques.

24 Apr 2024 (Wed) 12:00p.m – 2:00p.m

The emergence of Artificial Intelligence (AI) has ignited a fervent interest in AI-related stocks, prompting investors to speculate whether this marks the dawn of a new era or the beginning of a bubble about to burst. As AI technology continues to evolve and integrate into various industries, companies specialising in AI development, robotics, machine learning, and data analytics have seen exponential growth in their stock prices. However, with this rapid ascent comes skepticism about the sustainability of such valuations and concerns about potential regulatory hurdles, ethical considerations, and the threat of AI-driven job displacement.

Keen to find out more? Join Caleb as he unpacks the AI stock market this April.

In this complimentary live webinar, Caleb will share with you:

- Is US market Peak?

- Is China Hong Kong market bottomed?

- Singapore Market update

- Your individual stocks analysis

The webinar serves as a preview for the Mastering Price Action course

25 Apr 2024 (Thu) 7:00p.m – 9:00p.m

Systematic trading entails employing predefined rules and criteria to trade diverse financial instruments like stocks, bonds, commodities, or currencies.Instead of human intuition or discretion, systematic traders lean on computer algorithms for automated trade execution.

In this upcoming webinar, Andy will share his methods and tactics for establishing a supplementary income through systematic trading. Additionally, he’ll introduce his exclusive ART system, designed to optimize your trading endeavors.

In this complimentary live webinar, Andy will share with you:

- Understanding stock trading basics

- How the stock market functions

- Different strategies used in stock trading

- Develop your own strategies to trade stocks

The webinar serves as a preview for the Technical Analysis Systems Trading course

Past Webinars

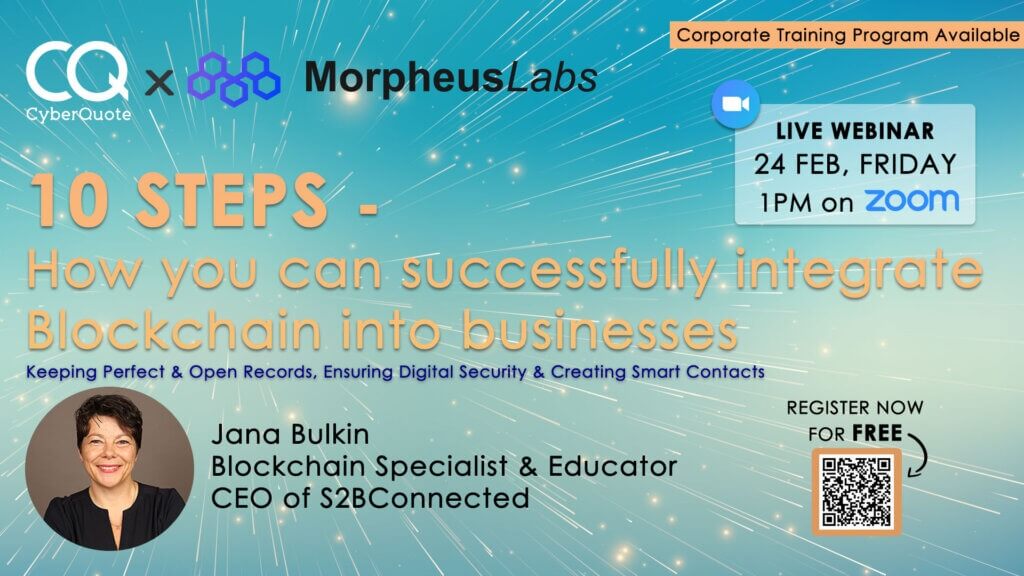

LIVE WEBINAR 10 STEPS - How you can successfully integrate Blockchain into businesses

Are you curious about how blockchain technology can be used in business?

Blockchain is a transformative technology that is changing the way businesses operate. It has the potential to revolutionize many industries, and we want to help you understand how it can be used in your business.

Join Jana as she shares with you the wonderful possibilities of how blockchain technology can help with your business.

Get ahead of others and be one of the first businesses to adopt this revolutionary technology.

There will be no recording provided for this webinar so be sure not to miss it!

All of our Zoom Webinars are password protected, which will only be provided upon registration on Zoom.

Key take away from this 2-Hour complimentary Webinar:

- What is Blockchain

- 10 step approach to find and implement for different cases

- Benefit of Implementing Blockchain into your Business

- Overview on the Blockchain ecosystem

The webinar serves as a preview for the Introduction to Blockchain course

LIVE WEBINAR Data Analytics With Excel , Power BI & Python

Data is the new commodity – in todays’ context the way we source for information and how we communicate said information has become pivotal for both individuals and organisations. Bring data to life with live dashboards, generate reports and craft out unique insights for your organisation by connecting to various data sources. Extracting, analysing data and sorting large quantities of data in a logical manner will help your business make well-informed and effective decisions.

Identifying best practices and knowing which are the right tools for data visualisation and analytics is a crucial factor in growing your organisation. Most businesses adopt visual-based tools such as Microsoft Excel or Power BI to help with the visualisation and analytics of data. While others use coding based tools such as Python for their data processing requirements.

Through this webinar, participants will have a glimpse into how industry experts utilise these tools to analyse and visualise data.

There will be no recording provided for this webinar so be sure not to miss it!

All of our Zoom Webinars are password protected, which will only be provided upon registration on Zoom.

Key takeaways from this webinar include:

- Introduction to Data Analytics & Visualization

- The adoption of Data Analytics in the industry

- How to analyse data and efficiently derive business insights

- Discussion of visual and coding based tools such as:

- Excel and PowerBI

- Python

- Live demonstrations of various functions in Excel, Power BI and Python

- Case studies of how analytics is used in the industry

- Derive a better understanding of how these digital tools fit into your organization