Financial Technology

MetaStock

G-Series Trading System

Compliance Alert System

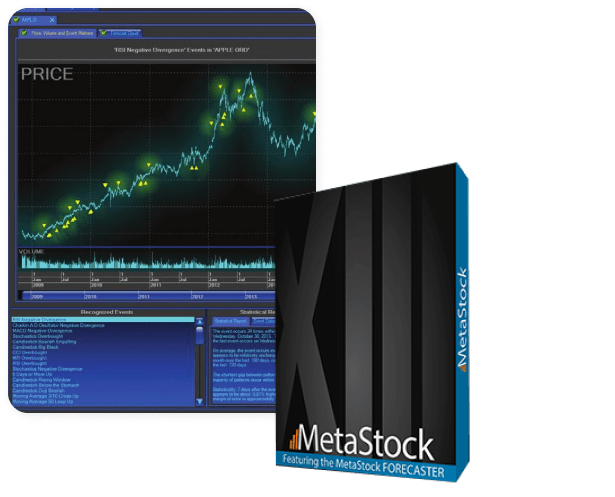

MetaStock

MetaStock® is created by Equis International 29 years ago and had been owned by Thomson Reuters. In 2013, Innovative Market Anlaysis responsible for supporting, developing, and programming the software as well as management of MetaStock® customer accounts. MetaStock® provides wide range of analysis tools including well-known indicators, simulation system testers and Forecaster. MetaStock® can also be used to develop filters and conditions according to your own preferences to explore investment opportunities.

CyberQuote(HK) provides End-Of-Day data which contains Hong Kong Stocks, Hong Kong Index & Futures, Foreign Index & Futures and Forex, most of the data start from year 1993. We also do adjustments on Hong Kong Stocks data including ex-dividend, rights issue, bonus shares, splitting and mergers.

G-Series Trading System

G-Series Stock Trading Platform is a web-based platform for broker-dealers designed to automate trading contract settlement and clearing. Most importantly, our platform brings transformative operational advantages to global post trade processing and management from trade capture through clearance and settlement, reconciliation, asset servicing, and regulatory reporting.

It streamlines and standardizes operations and infrastructure across multi asset classes, markets, currencies and business entities. Invest in what really makes a difference, with our trading platform technology to ensure your business is running smoothly.

Compliance Alert System

Regulatory and Exchanges show concerns at trading activities, such as AML, Due Diligence, Clearing Rules, Trading Rules, etc. This is about automate detection of abnormal trading activities.

System reduces compliance cost as manual checking task can be replaced and thus to minimize human error. Scalable design allow users to add new alert rules easily.

Compliance Alert System

Regulatory and Exchanges show concerns at trading activities, such as AML, Due Diligence, Clearing Rules, Trading Rules, etc. This is about automate detection of abnormal trading activities.

System reduces compliance cost as manual checking task can be replaced and thus to minimize human error. Scalable design allow users to add new alert rules easily.